30+ Alaska Paycheck Calculator

As with other states Alaska residents have federal and FICA taxes withheld from their paychecks. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

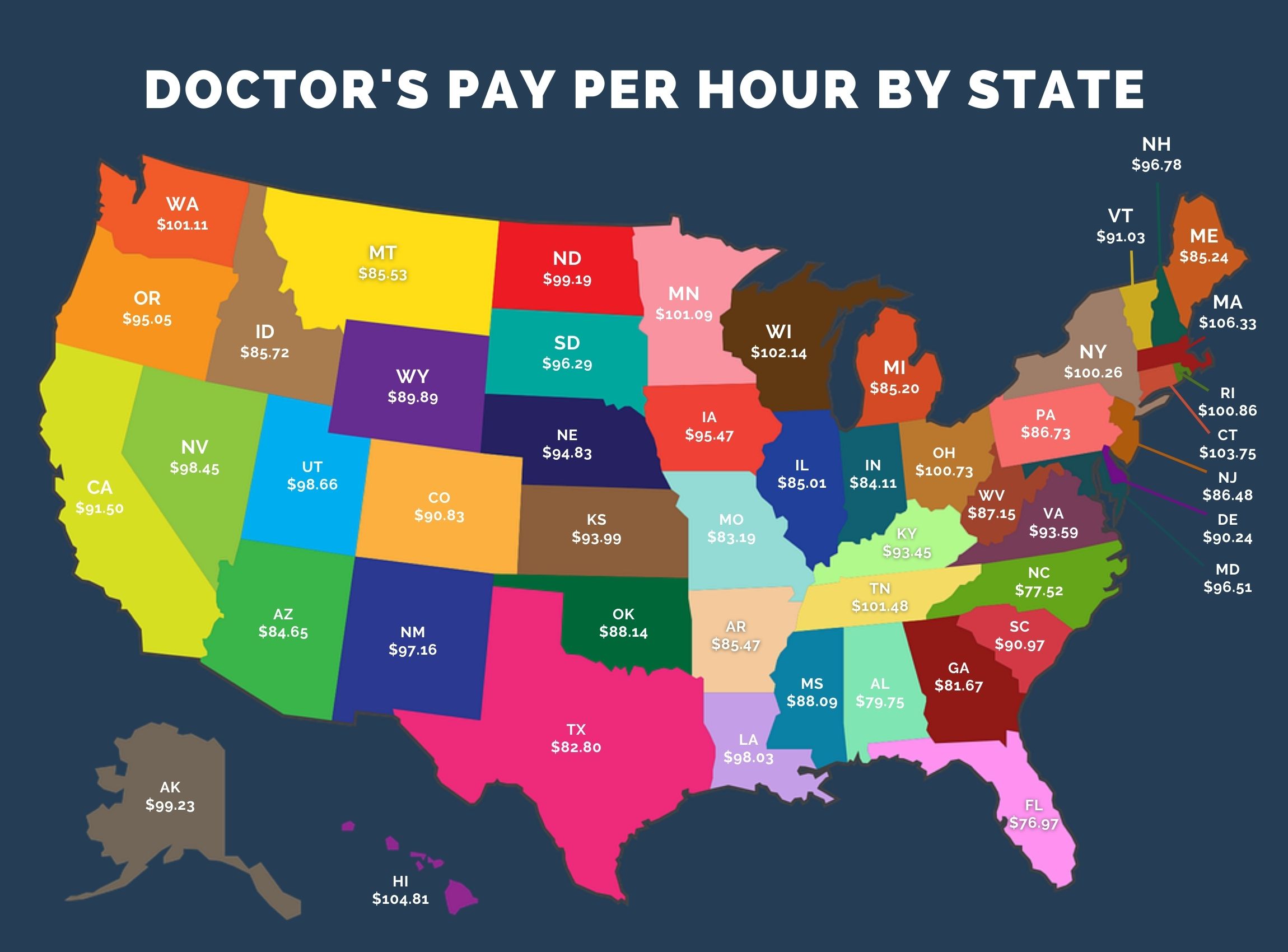

How Much Do Doctors Make In An Hour Breakdown By Specialty Prep For Med School

The End Date of your trip can not occur before the Start Date.

. So the tax year 2022 will start from July 01 2021 to June 30 2022. Alabama tax year starts from July 01 the year before to June 30 the current year. Rates are available between 1012012 and 09302022.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Prop 30 is supported by a coalition including CalFire Firefighters the American Lung Association environmental organizations electrical workers and businesses that want to improve Californias air quality by fighting and preventing wildfires and reducing air pollution from vehicles. Figure out your filing status.

Our paycheck calculator is a free on-line service and is available to everyone. Calculating your Ohio state income tax is similar to the steps we listed on our Federal paycheck calculator. And spends annually an amount equal to the spending of a household earning the median US.

ASCII characters only characters found on a standard US keyboard. Injury and Illness Calculator. Calculating your California state income tax is similar to the steps we listed on our Federal paycheck calculator.

Some states follow the federal tax year and some start on July 01 and end on June 30. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. Was devised by a single corporation to funnel state income taxes to benefit their company.

The state tax year is also 12 months but it differs from state to state. 2021 and end on September 30 2022. Popularized by Elizabeth Warren in her book All Your Worth this budget divides 100 of your paycheck after-tax income into the three categories.

No personal information is collected. So the tax year 2022 will start from July 01 2021 to June 30 2022. Minnesota tax year starts from July 01 the year before to June 30 the current year.

Get a little extra money before your next paycheck with an Advance America Payday Loan also called a Cash Advance. Rates for Alaska Hawaii US. It can also be used to help fill steps 3 and 4 of a W-4 form.

So the tax year 2022 will begin from July 01 2021 to June 30 2022. Regulators are leaning toward torpedoing the Activision Blizzard deal. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Maryland tax year starts from July 01 the year before to June 30 the current year. Property tax falls under local not state jurisdiction. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

6 to 30 characters long. Less than half of US states have no supplemental tax while the rest range from 184 to 11except Vermont which charges 30. Hello and welcome to Protocol Entertainment your guide to the business of the gaming and media industries.

Territories and Possessions are set by the Department of Defense. Figure out your filing status. Figure out your filing status.

Assumes Median US. Illinois tax year starts from July 01 the year before to June 30 the current year. Work out your adjusted gross income Net income Adjustments Adjusted gross income.

30 AM ET M-F are typically funded to your bank account by 5 PM ET same-day. This Friday were taking a look at Microsoft and Sonys increasingly bitter feud over Call of Duty and whether UK. Federal Paycheck Calculator Calculate your take home pay after federal state local taxes Updated for 2022 tax year on Aug 02 2022.

The Medicare tax is 29 of each employees gross wages while. This money goes to the IRS which puts it toward your annual income taxes and in the case of FICA taxes Medicare and Social Security. It is a Trojan horse that puts corporate.

Work out your adjusted gross income Net income Adjustments. Dont be fooled he says Prop 30. Figure out your filing status.

Work out your adjusted gross income Net income Adjustments Adjusted gross income. 50 Things You Want. 2022 tax rates for federal state and local.

Median household property tax payments from analysis performed by the Tax Foundation as a percentage of median household income from the Census Bureaus 2018 American Community Survey cites these as the counties with the most expensive property tax. Employment and Wages Data Viewer. Household has an income equal to 63218 mean third quintile US.

This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes. Regions States Areas at a. Calculating your Alabama state income tax is similar to the steps we listed on our Federal paycheck calculator.

2022 tax rates for federal state and local. Figure out your filing status. Microsoft describes the CMAs concerns as misplaced and says that.

Not based on your username or email address. So the tax year 2022 will start from July 01 2021 to June 30 2022. Approvals after 1030 AM ET are typically funded in the morning the next banking day.

Maryland Paycheck Calculator Calculate your take home pay after federal Maryland taxes Updated for 2022 tax year on Aug 02 2022. The lean and easy-to-understand 50-30-20 budget calculator has been around since at least the early 2000s. Work out your adjusted gross income Net income Adjustments Adjusted gross income.

JPMorgan Chase has reached a milestone five years in the making the bank says it is now routing all inquiries from third-party apps and services to access customer data through its secure application programming interface instead of allowing these services to collect data through screen scraping. Owns a car valued at 25295 the highest-selling car of 2021. Illinois Paycheck Calculator Calculate your take home pay after federal Illinois taxes Updated for 2022 tax year on Aug 02 2022.

Owns a home valued at 217500 median US. At least 1 number 1 uppercase and 1 lowercase letter. CPI Inflation Calculator.

So the tax year 2022 will start from July 01 2021 to June 30 2022. So the tax year 2022 will start from July 01 2021 to June 30 2022. Follow the steps below to calculate your take home pay after state income tax.

Economy at a Glance. Must contain at least 4 different symbols. Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off.

And even provide you with a sample fee calculator to. This calculator is intended for use by US. For instance in California employees are taxed 66 for most supplemental pay but are taxed at 1023 if the supplemental pay is received from a bonus or stock option.

States with the highest and lowest property taxes. Industry Finder from the Quarterly Census of Employment and Wages.

Alaska Paycheck Calculator 2022 2023

Hourly Paycheck Calculator Nevada State Bank

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Free Paycheck Calculator Hourly Salary Usa Dremployee

Alaska Income Tax Calculator Smartasset

Alaska Hourly Paycheck Calculator Gusto

Salary Calculator Employee Salary Calculator Tool

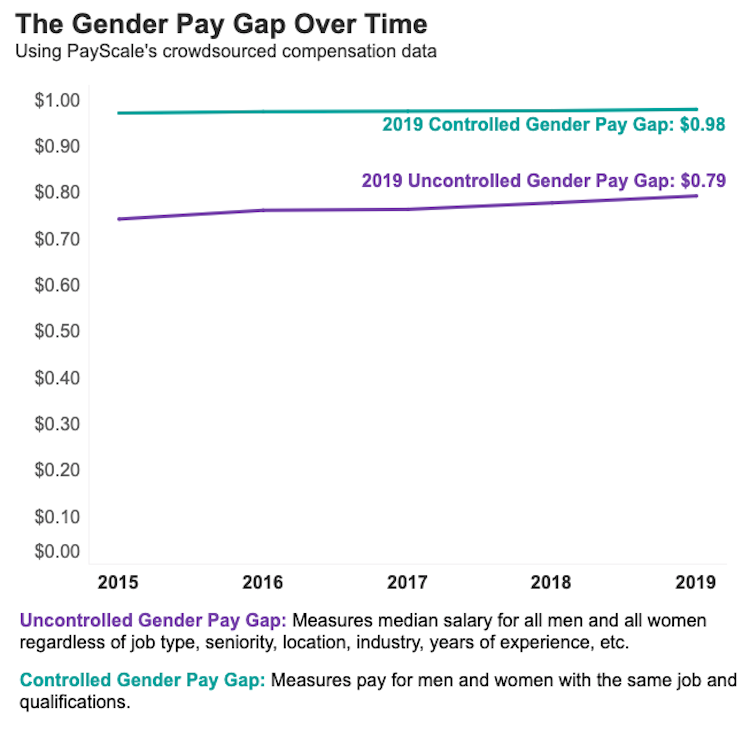

30 Gender Pay Gap Statistics For 2022 Built In

Teacher Salaries In America Niche Blog

Mississippi Paycheck Calculator Smartasset

Garmin Enduro Gps Watch In Depth Review Dc Rainmaker

Occupational Therapist Salary Data From 2 322 Ots And Cotas Myotspot Com

A Content Analysis Of 32 Years Of Shark Week Documentaries Plos One

Paycheck Calculator And Salary Calculator Employment Laws Com

Proceedings From The 12th Annual Conference On The Science Of Dissemination And Implementation Springermedizin De

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022